My go to activity to pass time with my trading friends is the market making game. It works with two players, gets more fun with a larger group, and is a playful way to sharpen trading intuition. It has also become the canonical ritual in my circle for deciding who picks up bill at dinner.

rules

propose a market

One player suggests a question whose answer can be verified. This has gotten easier as chatGPT has become a better oracle. For example, How old is our waitress?

auction for the market maker seat

Players take turns quoting the size of a confidence interval. The proposer is trying to capture the waitress’s true age while keeping his interval as wide as possible. A first quote might be 20 years wide, meaning the player believes that he can predict the waitress’s age within a range of 20 years.

Someone else may then bid 15 wide because he thinks he can predict her age within 15 years. Each new bid must narrow the previous interval by at least 10% to prevent pennying. Bidding continues until no one will quote a tighter range. The narrowest bidder becomes the market maker. All else held equal, it is advantageous to be the market maker.

market maker sets the range.

Let’s say the auction settles with the narrowest bidder setting his interval at 1 year wide. The market maker believes the waitress’s true age is 22.5 years old, known as his theo or theoretical value. He sets his range at 22 @ 23, meaning he believes the waitress is between 22 and 23 years old and is willing to buy any guess at 22 and sell any guess at 23.

trade against the market.

Everyone else now chooses a side of the maker’s range. They may sell the lower bound, betting the true value is below it, or buy the upper bound, betting it is above. The distance between the two bounds is the spread, which represents the maker’s margin for error. Everyone must trade.

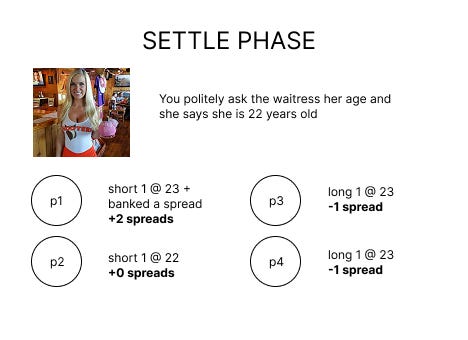

settle and score.

After the trades are made and the positions are set, reveal the true value, settle gains and losses, and record results in units of spreads so scores stay comparable across rounds.

game 2

In this game, the market maker’s interval doesn’t contain the true value but is able to still break even because he was able to lock in a spread by selling 14m and buying 12m.

This game highlights the importance of two way flow. Market makers don’t need to make perfect forecasts if there is enough liquidity from differing views in the market. This spread he captured was able to offset his loss from the adverse selection of being directionally wrong on the forecast. As the number of players in the game increases, it becomes more advantageous to be the market maker.

game3

In this game, the market maker sets his market too high and has the entire crowd selling into his bid and ends up losing 3 spreads. The danger in being the market maker is being adversely selected and picked off in one direction if his estimate of the fair value is wrong.

game4

This round shows the chaos that erupts when a market has no natural ceiling on losses. Because the players’ estimates are scattered by several orders of magnitude, a single mispriced market can swing the entire series.

p1 and p3 lock into a bidding war. They both know that women ovulate about once a month until menopause, roughly a thousand eggs released over a lifetime, so they assume overall scarcity. That line of reasoning pushes them to keep narrowing their spread down to 25k eggs. Their shared misconception drives the market maker’s spread down.

Being short in a market without an upper bound is dangerous. A trader who sells at 25k can earn at most 2.5 spreads per contract if the answer were zero, yet the downside is unlimited. In earlier rounds the upside risk was capped — Zimbabwe is unlikely to hold more than 100 million people and kangaroos will never jump 20 feet high. Here the ceiling is undefined, so every short quote is a potential time bomb.

The order flow itself offers clues. p4 opens with a one million egg bid and never tightens. p2 never places a bid at all. Both signals suggest that some participants suspect a very high true value and are eager to buy anything below 100k. p1 and p3 ignored the hints, the spread collapsed around a faulty anchor, and p3 being the biggest loser at the end of the series, has to pick up an extravagant seafood dinner.

misc

The auction phase is where you begin to glimpse everyone else’s theoretical value. Watch how tight of a spread each person is willing to bid. Watch how they respond to another player’s market. Stay alert for deliberate feints, because an over reaction can be planted as easily as a real one.

Infinite loss markets are the most chaotic and the most fun. They turn the game into an exercise in defense as much as offense. A few fun ones you can try with friends:

How many hairs cover a single spiny lobster

How many Earths would fit inside the Sun

How many individual ants are alive on Earth right now

How many distinct words exist across every living human language

These Fermi problems are inherently ridiculous, which makes them fun to reason through, though it is even more satisfying to watch a friend drop a hundred spreads and then asking for the check.

Give the game a shot, let me know any wild markets you invent, and if you are in New York this summer let me know and we can kick it and play some market making games.

We learned it as "trade or tighten", very fun