Both of us are named Alex, so in order to avoid confusion I refer to him as “Zlex” (pronounced zee-lex) and he refers to me as “Thiccy (pronounced thick-ee)”.

I first noticed Zlex in my senior year of college in a competitive programming class. I liked to sit in the very back of row of class so I could play internet poker. Zlex sat in the row in front of me. He had a tall and wiry build, had long messy brown hair, sat in an unusually upright posture, and would always be wearing those free career fair company t-shirts.

He had an intense stare and always looked very focused. Every now and then I would glance at his screen and he would be drafting problem sets for coding competitions the class would hold. As soon as class ended, Zlex would snap his laptop shut, stand up, and briskly walk straight out of the classroom without saying a word.

We were both involved in a quant finance club. Zlex joined at the same time as me, but was a couple of years younger. Every week the club required us to do a presentation on a quant related side project.

During my presentation on PCA, Zlex seemed like the only person that was paying attention and asked a few good questions. Afterwards, he struck up a conversation with me and mentioned that not only did we share the same name, but the girls we were dating at the time also shared the same name.

He was friendly, talked very fast, and we were able to communicate abstract concepts effortlessly with each other. We saw each other weekly at the club meetings for the rest of the semester, and made small talk every now and then.

The following semester was light for me so I had a lot of free time. I would play four tables of 100 NL poker in the basement of the computer science building to pass time.

Zlex tapped on shoulder one day and asked if he could watch.

Sure, I responded pulling up a chair.

He asked me if I would explain my thought process so that he could get better at poker. We bluffed people off of a few big pots and showed them complete air afterwards, trash talking them in the chat, cackling at their angry responses. We were having so much fun that we lost track of time and Zlex completely missed the lecture he was supposed to attend. I could tell quickly that he had the same addictive and obsessive tendencies around games that I had.

It became a weekly Tuesday/Thursday routine for us. Zlex would find me in the basement and we’d run poker together. He was a fast learner and always asked the right questions. It felt like we spoke the same language and could communicate with each other with just a few words.

Over time we added chess into the rotation. Zlex had a 2400 bullet chess rating and was unusually quick. I could tell his brain just operated at a higher clock speed than anyone I had met before. He would often find himself in losing positions but flag his opponent on time after a flurry of last second moves. Of course we would never forgo the opportunity to trash talk in the chat whenever we won.

We would sneak into the graduate lounge, get a little baked, and play ping pong for hours, talking about life, families, girlfriends, and friends, all while logging prop-bet scores after each game. Somewhere between forehands and trash talk, the first sketch of our market making game took shape.

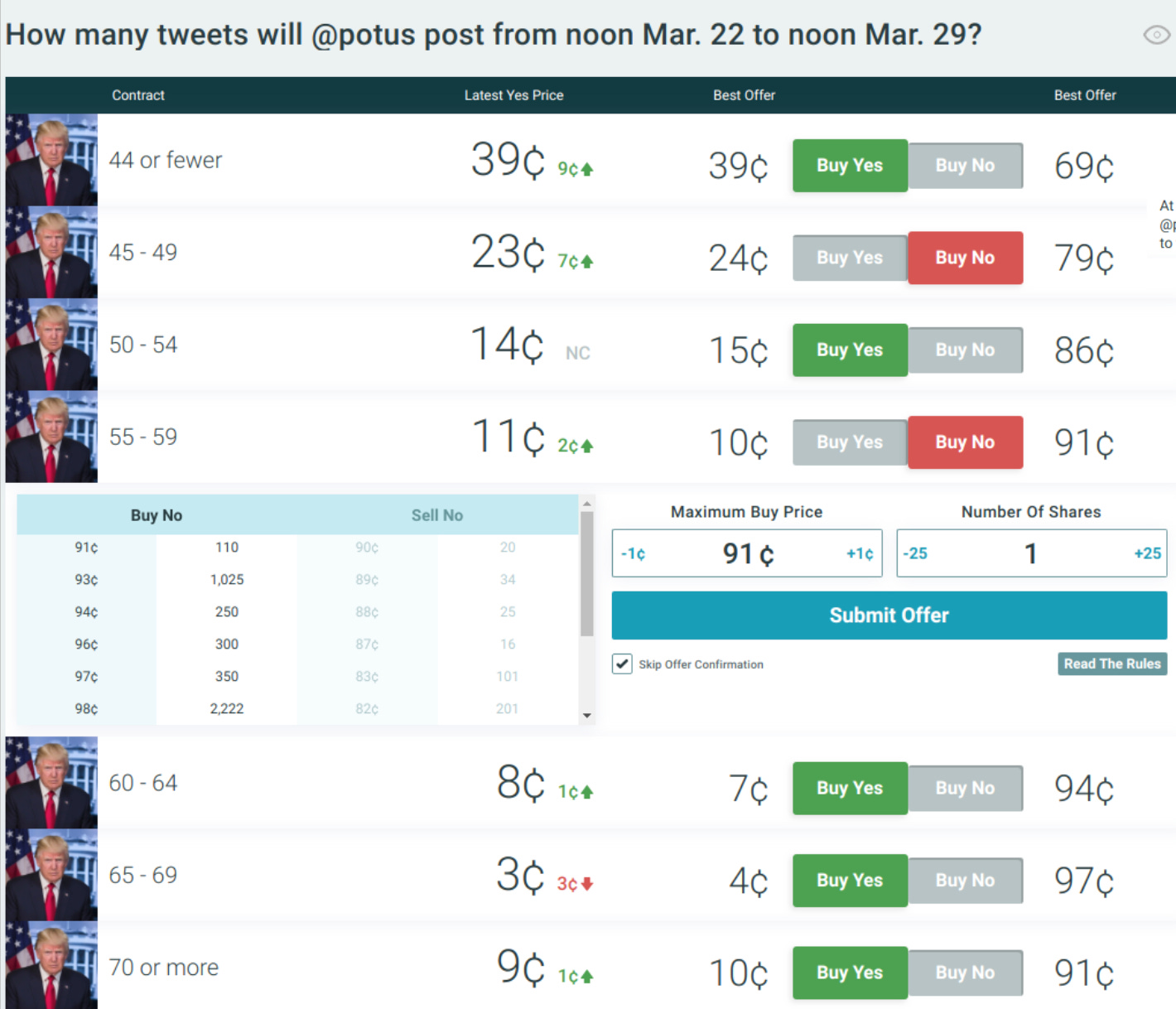

A month passed and we started working together on a trading side project on Predictit, a popular political betting market. On Predictit there were these markets where people could bet on how many times Trump would tweet this week.

People would place bids and offers on ‘No’ and ‘Yes’ with the cent value corresponding to the probability of occurring.

In the example below, traders thought there was a 39% chance Trump would tweet 44 times or fewer in a week, 23% chance he would tweet 45-49 times, 14% chance he would tweet 50-54 times, etc. The markets would run every week and would settle at noon on Fridays.

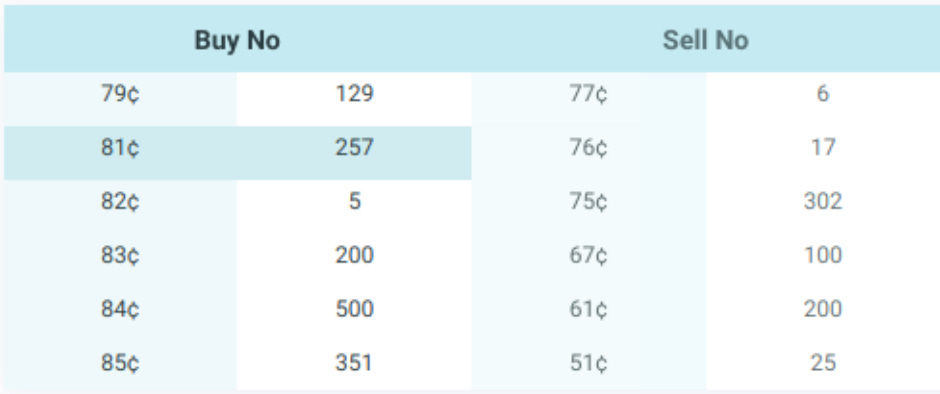

In this example you could buy ‘No’ for 79 cents meaning that you thought there was a 79% chance that the total tweet count would not be in between 55 to 59 times. If you were correct at the end of the week, the shares you bought would be worth $1.

There was a ‘No’ share and a ‘Yes’ orderbook were essentially mirrored. A buy of ‘No’ at 79 cents would appear as a a sell of ‘Yes’ at 21 cents on the other side.

As you approached the end of the week, we noticed that the markets would get very volatile as every tweet would cause large shifts in the probabilities of buckets. Trump would often burst out three or more tweets in rapid succession.

We quickly realized that after Trump tweeted for the 60th time for example, the 55-59 bucket was pretty much worth 0 (unless he deleted a tweet). However there would be stale orders willing to sell ‘No’ at 97, 98 or 99 cents that should be trading at a dollar. We set up web scrapers on twitter that would poll Trump’s twitter page. If he tweeted, our scripts would check if there any buckets we could sweep, and if so, we would go and buy all of the No shares. We set up multiple instances of the script in each AWS region, ensuring that we’d win the speed race.

Our operation was pulling in $400 per week, roughly $100 on each market over 4 tweet markets (potus, whitehouse, realDonaldTrump, Mike_Pence). At the time it felt like we were raking it in.

We worked on stat arb strategies next. We made quick and dirty models over each account’s tweet patterns and would pick off stale quotes after each tweet that seemed statistically underpriced according to our models.

We compiled snapshots of the orderbooks to estimate how far into the book we could remove into after each tweet depending on how far we were into the week and how far the bucket was away from the projected tweet amount for the week.

Zlex was a much stronger developer than me. He was incredibly quick at building minimal viable products and most importantly his code always worked bug free. We made a good team where I would focus more on the trading and he would focus more on the development.

One day I was prototyping our strategies and forgot to set the test flag to true in Knight Capital fashion and ended up maxing our account with a few thousand dollars worth of erroneous positions. A wave of disappointment and dread washed over me, not just for the hours of work I had jeopardized but for the damage I feared my careless error might do to the partnership.

I shared the bad news with Zlex. After taking a moment to survey the situation, he started cutting us out of the positions, realizing a $500 loss for us in slippage.

Zlex shrugged it off pretty quickly.

“We’ll make it back” he said, adding a few more safeguards into the testing framework to ensure this couldn’t happen again.

Instead of a lecture or a sigh he met the error with composure and shared the loss without second thought, a small but immensely meaningful gesture to me. It was proof that the partnership mattered more than any single trade and its value was not just in how we celebrated the same victories but also how it held up under stress and turned mistakes into opportunities to course correct together.

From that day I no longer thought of him as a friend but as a brother. The two of us walked out of the lab already scheming on how we would bounce back harder than ever before.

Unfortunately, we never made it back.

Soon after, Predictit banned our account because our automated trading had violated their terms and conditions. We had to shut the whole operation down.

It was a bummer, but we moved on to other small scale trading projects. I started reading more books about trading like Market Wizards by Jack Schwager and Flash Boys by Michael Lewis and realized that what we were doing on Predictit was not so different to what the big fellas were doing in the major leagues.

Zlex turned to me one day in the computer lab and declared “We are going to make a hundred million dollars one day.”

I asked him if he was baked but he shook his head.

He closed his laptop and looked at me again with a look I had never seen and in a voice that didn’t waver, “We are going to make a hundred million dollars one day.”

Something awakened in me when he said that. For most of my life I thought that working a well paid salaried job was the pinnacle of achievement.

There was this fire that burned in his eyes as he looked at me.

This unshakeable self belief that he could outcompete the world and win.

After that moment, the ceiling I had previously accepted for myself was shattered, and his confidence made space for my own self belief to grow.

Three years later we both quit our jobs and launched a trading firm together and the rest is history.

Looking back, I see that what felt like an instant chemistry was actually a slow cumulative buildup of small exchanges. Neither of us were set out to find a cofounder or make new friends. It made me realize that simply practicing your obsessions in public where anyone can wander by is a reliable and effortless filtering mechanism to find people that you align with.

The lesson now shapes how I seek every long term relationship, romantic, professional, or platonic. I think we index too hard on the first impression and don’t leave enough room for the second, third, and tenth impressions. The most aligned connections I’ve learned are rarely formed in serendipitous flashes of lightning like in the movies but rather formed gradually and effortlessly like sediment through hundreds of micro-interactions, shared quests, small victories and the occasional defeat.

Thanks for reading :)

how to get dirty at poker?